The Adelaide greenfield market is increasingly on the radar for residential land developers. Adelaide’s latest house price boom has shifted the dynamics for new house-and-land packages, with land sales now poised to stay on a permanently higher plateau.

A Shift in Price Relativity

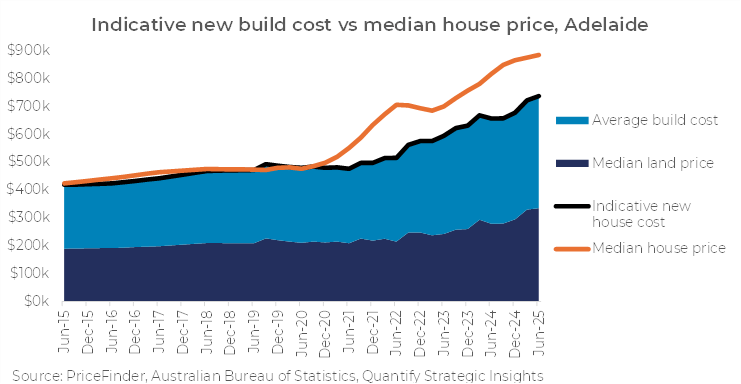

The cost of building a new home has surged, driven by escalating construction costs and growing land values. Adelaide has been no different. Between June 2020 and June 2025, Adelaide’s median land price increased by an estimated 59%, while the average build cost of new house approvals has increased by 50%. However, these rises have been trumped by the 86% growth in Adelaide’s median house price.

So, what does this mean?

Up until 2020, the cost of an indicative new house (median land price plus average build cost) was around the same as Adelaide’s median house price. In some of the more affordable locations, such as in Playford Local Government Area, the price of an existing house, often on a larger block and in suburb with infrastructure already in place, was even significantly cheaper than a new build only a suburb away. A new house wasn’t necessarily the most affordable option.

However, rises in established house prices since 2020 have substantially outpaced growth in new house prices, making new housing more attractive in relative terms.

As the chart below shows, over 2015–2020, the indicative cost of a new house in Adelaide (land + build) was similar to the median established house price, rising from around $420,000 in 2025 to $480,000 or so by 2020. However, by June 2025, the median price of a new house, at $885,000, was well over the indicative new house price of $738,000 (median land price of $335,000 plus average build price of a new home of $403,000).

In other words, after being similar in 2020, a new build is now $147,000 cheaper than the median house price, which has become increasingly attractive to first-home buyers and upgraders trading to a larger new dwelling from an established suburb.

Sustained Demand for Land

The increased financial attractiveness of the greenfields in Adelaide contrasts with Sydney and Melbourne, where the median house price rise by only 37% and 15% respectively over 2020–2025—well below prices of new housing in both these markets. As a result, demand for new builds and consequently land have collapsed in these markets.

The outcome from this improved pricing relativity in Adelaide is a key reason developers are giving the market a closer look. The chart below highlights that sales volumes have tracked the increased affordability gap between new and established housing in Adelaide. Where land sales fell sharply in Sydney and Melbourne, Adelaide’s vacant land sales remain elevated. After peaking at over 7,800 annual sales during the HomeBuilder stimulus in 2021, volumes have moderated but are still above pre-COVID norms. In the year to June 2025, total land sales sat at 4,900, compared to an average of 3,500–4,000 per annum before 2020.

This sustained demand highlights the resilience of Adelaide’s greenfield market, and suggests a structural shift driven by long-term affordability and buyer preference.

Demographics are also Supportive

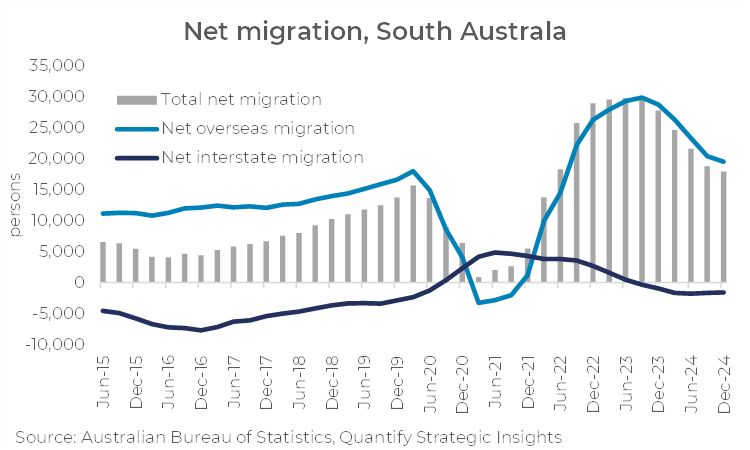

In addition, the population fundamentals are further supporting new housing demand. Net overseas migration remains above pre-COVID levels, although is easing. Similarly, South Australia experienced a net interstate migration inflow for the first time since the early 1990s over 2020–2023. While a net interstate migration outflow has returned, it remains lower than pre-COVD levels. As a result, total migration, and therefore population growth, remains elevated.

Developers Following the Numbers

This all means that from a developer’s perspective, the land market has become increasingly attractive:

Population growth is strong, while a growing number of purchasers are being priced out of the established market and turning to house-and-land as a more affordable path to home ownership.

Even with rising build costs, the end price point remains competitive, allowing developers to maintain sales momentum without excessive discounting.

With the new-vs-established price gap firmly in favour of new builds, developers have greater certainty on achievable sale values.

Furthermore, congestion issues are less pronounced in Adelaide than in the east coast capitals. Its road network and compact urban footprint mean many greenfield locations are within 30–40 minutes of the CBD or key employment nodes. Meanwhile, compared to the east coast capitals, the planning environment in South Australia is generally seen as less restrictive and more supportive of housing delivery.

The Adelaide land market has always been seen as a steady market, but without the volume to necessarily make the decision to base a business there. However, the weakness in Sydney and Melbourne, together with improved pricing fundamentals means that the Adelaide land market is no longer the quiet achiever. It is now on the radar for major developers looking to diversify and de-risk. A combination of structural affordability, sustained buyer demand, and development-friendly conditions is making it one of the more investable land markets in the country. For developers seeking value, scale, and demand certainty, Adelaide is ticking a lot more boxes in 2025 than it did a decade ago.

If you're looking to better understand the opportunities in Adelaide’s evolving land market, or want to test the feasibility of your next project, Quantify Strategic Insights can help. Our research and forecasting can provide the insights you need to make informed, strategic decisions. Get in touch to discuss how we can support your business with detailed market analysis, demand assessments, and price modelling, whether it is for the Adelaide market or any other major greenfield market in Australia. Contact Angie Zigomanis at [email protected] or Rob Burgess at [email protected]