National Overview

The latest Australian Bureau of Statistics ‘Building Approvals, Australia’ release shows that in March 2025, the total number of dwellings approved nationally were up by 19% on the same month last year to 15,388 units. While there was a decline for the month in seasonally adjusted terms, this continues the upward year-on-year trend through each of the first three months of 2025, which suggests some emerging momentum in the market.

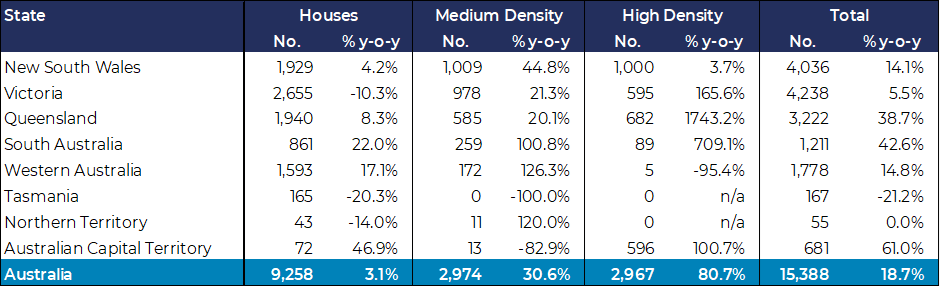

New house approvals were up in year-on-year terms by a modest 3.1% to 9,258 dwellings. Medium Density (villas, townhouses and walk-up apartments) dwelling approvals were up by 31% on March 2024, while High Density (apartments in buildings above 4 storeys) dwelling approvals recorded an increase of 81% and are now well up on twelve months ago.

Residential dwelling building approvals, March 2025

Source: Australian Bureau of Statistics

In annual terms, there were 180,123 new dwellings approved in the year to March 2025, which represents a 10% increase from the trough recorded in the 2023/24 financial year. While this growth is positive, it remains well below the Federal Government’s Housing Target of 1.2 million dwellings over five years (240,000 per annum) as well as the level of new dwellings required to support population growth.

House approvals (up 10%) and Medium Density Dwellings (+6%) have shown a moderate increase from their previous lows, while there has been a 31% pick up in High Density approvals (from 27,800 in year to June 2024, to 36,300 in year to March 2025).

High Density Approvals have shown strong growth this financial year, although this is indicative of depth that approvals have fallen to after peaking at nearly 80,000 per annum in 2015. The magnitude of the rise also reflects improving investor demand, as well as a stabilization of construction costs that have helped to support the feasibility of apartment projects.

Residential dwelling building approvals by type, Australia (Moving Annual Totals)

State and Territory Trends

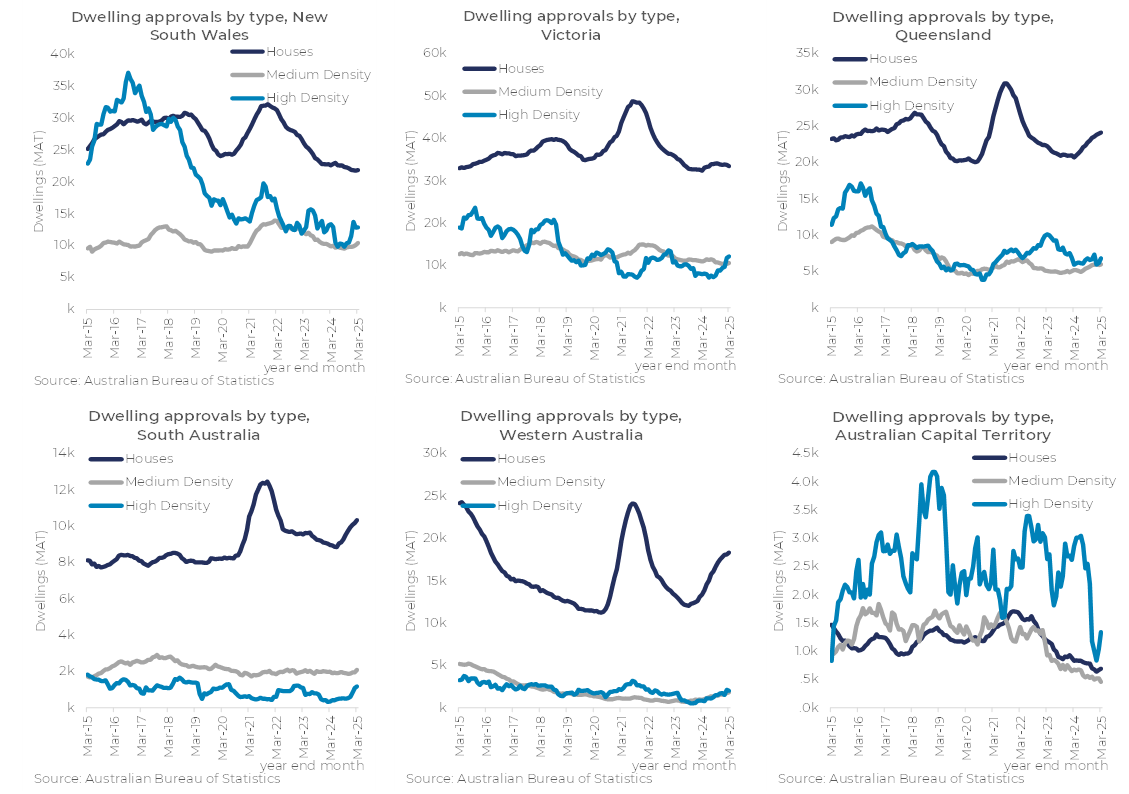

Queensland (+39%) and South Australia (+43%) did the heavy lifting, recording the largest year-on-year increases in total dwelling approvals. Together with Western Australia, there has been solid growth in new house and Medium Density approvals in these markets over the past twelve months, although it appears that the pick up in house approvals in Western Australia may be slowing, while Medium Density approvals in South Australia have been recently flat.

Approval activity in the new house market in New South Wales and Victoria remains muted, as does the Medium Density market, although there are signs that these markets have now picked themselves up off the bottom. In contrast there has been a solid uptick in High Density approvals in both states, albeit from a very low base. The upturn in Victoria has been more pronounced, with High Density approvals in the year to March 2025 almost on par with New South Wales.

While the Australian Capital Territory has enjoyed a good couple of months of High Density dwelling approvals, it has masked a substantial broader downturn in approvals across all dwelling types. Total dwelling approvals in calendar 2024 halved compared to the previous year, possibly reflecting local political uncertainty as well as the affordability issues facing the broader market.

Approval activity in both Tasmania and Northern Territory remains well down in previous peaks, although some signs of life may be emerging in the Northern Territory market.

Residential dwelling building approvals by type, Major States (MATs)

Outlook

A number of factors are expected to deliver tailwinds for new dwelling approvals in 2025:

Approval activity will continue to be underpinned by strong population growth and an undersupply of dwellings, with demand expected to be further supported by projected interest rate cuts through the remainder of 2025.

In addition to the effect on prices of lower interest rates, policies of the re-elected Federal Government are also likely to be mildly inflationary. Together with the stabilisation of construction costs, improved feasibility should allow more residential projects to proceed. This will particularly be the case in New South Wales and Victoria, where more muted recent price growth has stymied development.

The recent improvement in investor demand is also likely to be sustained to support the off-the-plan apartment market in particular. Lower interest rates and rising rents (albeit at a slowing rate) will improve the rent vs mortgage equation and attract investors. Lower fixed-interest returns and Trump-related ructions in the equities market may also see more investors seek the refuge of residential investment.

While affordability issues and feasibility challenges will continue to weigh on the residential market, these tailwinds should see new dwelling approvals continue to trend upwards nationally through 2025, as the strength of the Queensland, South Australian and Western Australian markets is joined by upturns in New South Wales and Victoria.

For further insight into the outlook for residential building and what it means for you, contact Angie Zigomanis at [email protected] or Rob Burgess at [email protected]